Significance of a Dragonfly Doji

The dragonfly doji is a powerful candlestick pattern that can provide valuable insights into the market’s sentiment. In this section, we will discuss the significance of a dragonfly doji and how it can be interpreted in both bullish and bearish markets.

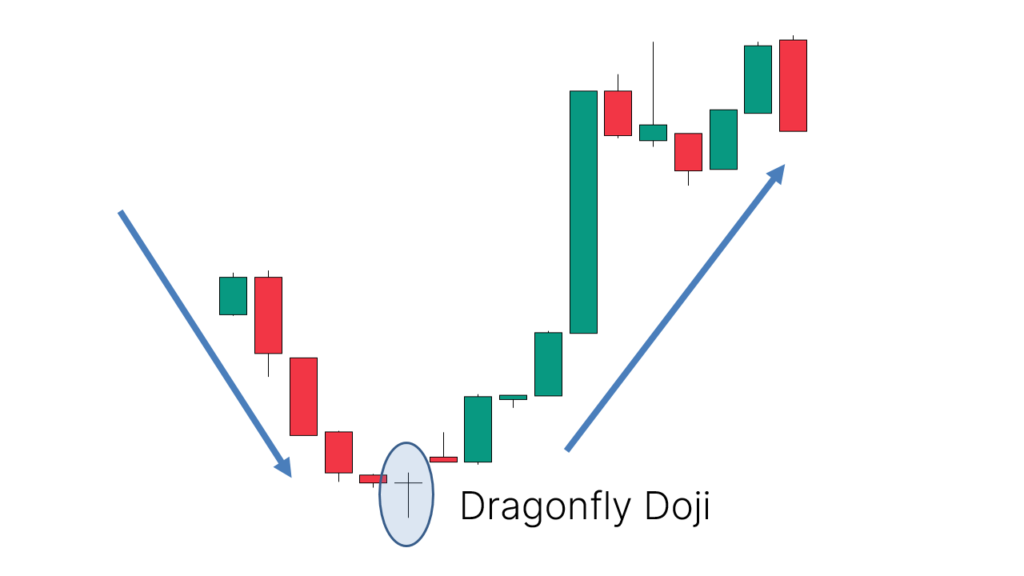

In a bullish market, the appearance of a dragonfly doji can indicate a potential trend reversal. It suggests that buyers have regained control, pushing the price up, and that the market may be ready for an uptrend. However, it is essential to consider other factors, such as volume and other indicators, to confirm this potential reversal.

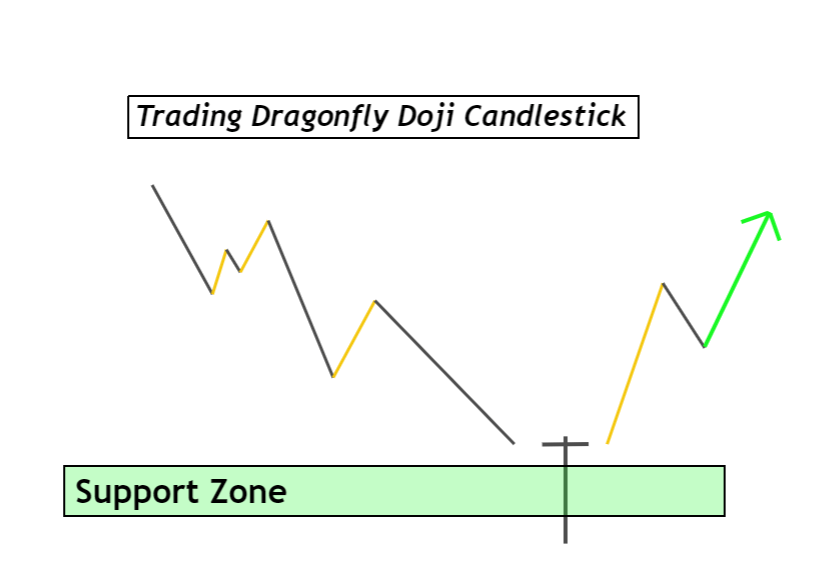

In a bearish market, the appearance of a dragonfly doji can indicate a possible bottom. It suggests that sellers have been in control, pushing the price down, but buyers have regained control, pushing the price back up to close near the opening price. This pattern can indicate that the market may be ready for a potential uptrend. However, as with a bullish market, it is essential to consider other factors to confirm this potential reversal.

The psychology behind the dragonfly doji pattern is essential to understand. The long lower shadow suggests that buyers have been in control during the trading session, but the sellers have managed to push the price down. However, as the session ends, buyers regain control, pushing the price back up to close near the opening price. This tug of war between buyers and sellers creates a state of balance and indecision, potentially leading to a trend reversal.

Overall, the significance of a dragonfly doji is that it can provide valuable insights into the market’s sentiment and potential trend reversals. However, as with all candlestick patterns, it is essential to consider other factors and technical indicators to confirm potential reversals and make informed trading decisions.